Global market for flat glass

Current scenario

The global market for flat glass in 2004 was approximately 38 million tones, which represents a value of EUR 15 billion at the level of primary manufacture. An overwhelming 70 percent of the flat glass manufactured in the world is used for windows and glazing for buildings and another 20 percent is used for furniture and other interiors applications in buildings. The remaining 10 percent is used for automotive glazing.In terms of usage within the building products market, about 40 percent of the glass demand is for new build, 40 percent is for refurbishment and 20 percent is for interior applications.

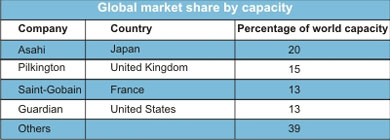

Market players

Pilkington, Saint-Gobain, Asahi and Guardian are the four companies that produce 61 percent of the world's high quality float glass. It is a consolidated market. While Asahi is a Japan-based company, Pilkington is based in the United Kingdom, Guardian in the United States and Saint-Gobain in France. There about 12 other organized players besides the top four and several unorganized ones, mostly situated in China and produced low quality products. The percentage share of these in terms of capacity is illustrated in the following table.Geographical markets and level of maturity

Growth in demand

The demand for glass has grown phenomenally in the last two decades, outstripping the GDP growth in most countries. Largely fuelled by China, the demand for glass is expected to grow at nearly 4 percent per annum.The demand for glass is fuelled by legislation and regulations that look at safety, noise control and energy conservation. Design trends that favor glazed buildings that allow for maximum natural light will ensure the growth of the glass industry.

Markets by type of glass

It is encouraging to note that much of the low quality float glass is being replaced by high quality products, mainly due to the efforts of these organized and large players to educate the market, demonstrate the advantages of better quality and facilitate the adoption of high quality materials at not very much higher costs.

In fact today, the demand for value-added glass is growing at a faster rate than demand for basic glass. Though the majority of the demand is from North America and Europe, value-added glass is gaining ground in less mature markets as well, with safety, security and energy conservation becoming priorities for building designers worldwide.

The Indian market scenario

Structural glazing and curtain walling were first seen in the United States in the mid 40s. From North America, the technology spread first to Europe, then to Australia and then to South East Asia. The first building in India that had a curtain wall was the Le Meridian Hotel in New Delhi, which was constructed in the early 80s in preparation for the Asian Games. By the 90s, curtain walls were accepted as standard technology for high-end buildings in the country, with an explosion of projects in Mumbai and the NCR region, and later, in Bangalore, Hyderabad and Chennai, driven by the IT boom. Today, structural glazing is a norm rather than an exception for malls and corporate structures across the nation.The glass and glazing industry for architectural application in India for the year 200 was estimated at a minimum of Rs 100 crores. Of this, the glass component would be about 1.2 million square meters. Indian and imported ACP would come to about 1 million square meters and another 700,000 square meters would constitute residential windows.

In geographical terms, the South Indian region dominated by Bangalore, Chennai, Hyderabad and parts of Kerala, contributes to 30 percent of the glass consumption. West India follows with 29 percent. Here Mumbai, Pune and parts of Gujarat are big consumers. The North Indian market, comprising mainly of Delhi and the National Capital Region accounts for 20 percent of the total architectural glass and glazing market. East India currently contributes only 7 percent of the consumption. However, with a renewed focus on real estate in West Bengal, this is set to change and this regional market is growing very fast.

Glazing market size: India

The sheer capacity for production of glass in India is so low as compared to other countries. India at present has about 3-4 float lines and 14 glass processors. In comparison, China has 140 float lines and over 800 glass processors. The Chinese glazing market for 2004 was estimated at between USD 4-5 billion.

Capacity addition in the future

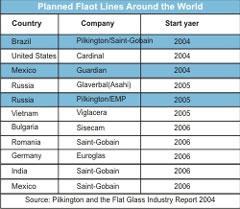

At a global level, demand is growing steadily and the glass industry will continue to grow at 3.9 percent per annum in the medium term. To satisfy this growth, companies will add about 100 new float lines worldwide by 2010.While China is adding about six float lines over 2004 and 2005, there are at least 11 high quality float lines in various stages of planning and execution around the world. A list of these is given below. Most of these will start production in 2006. Besides these, about 15 lower quality float lines are said to be coming up in China.

India will see an addition on at least 4 more float lines and at least 10 more processors by mid 2006.

Outlook for Indian glass industry