The climate change crisis and its far-reaching consequences have made clear the urgent need for standardizing, measuring, and accounting for sustainability as a part of organizations and their businesses. This has led to a transformation in organizational operations and practices where now “Environment Friendly” has evolved from a mere catchphrase to a board meeting agenda. Given the necessity and significance of climate actions being taken up, universal guidelines are required to measure the impact of practices followed such that businesses can be held accountable.

ESG Reporting is one of the most widely accepted set of criteria encapsulating the accounting of environmental, social, and governance practices. ESG has become an important metric in the market - companies with good ESG performance proven to have lower risks, higher returns, and are more resilient in times of crisis.

India has introduced new ESG reporting requirements for the top 1,000 listed companies in the country by market capitalization. The Securities and Exchange Board of India (SEBI) stipulates that the disclosure must be made through a new format, namely the Business Responsibility and Sustainability Report (BRR) which is mandatory from FY 2022-23.

The collateral value derived by aligning with the UN’s Sustainable Development Goals and world climate targets as well as the rise in social status has become a bonus outcome for developers and investors.

Gurmit Arora

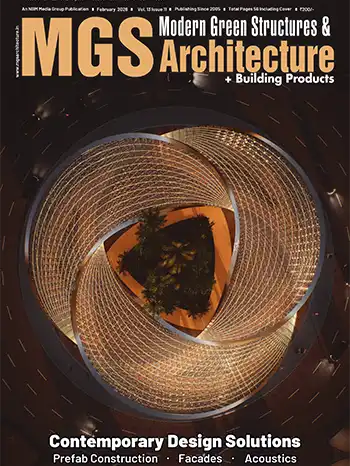

Buildings & the Built Environment

According to a report by WorldGBC, the built environment (capturing buildings and infrastructure) represents one of the biggest global investment opportunities of the next decade, an avenue to enhance sustainable development and human quality of life, and - if tackled correctly - reduce emissions and combat the climate crisis.

Globally, the built environment is responsible for 75% of GHG emissions, with the building sector on its own accounting for 37%. In India, about 22% of the total emissions are from the building sector, which also is one of the largest consumers of natural resources.

Additionally, it is estimated that about 70% of the infrastructure required by our country’s urban areas by 2030 is yet to be built. Therefore, over the next two decades, the construction sector will have enormous capability and scope to inculcate sustainability across the built environment.

Companies and their property portfolios have the potential to play a significant role in achieving their ESG targets. Additionally, the financial impact of having resilient assets, which are as risk-free as possible, has been the biggest driver for the adoption of ESG Reporting. The collateral value derived by aligning with the UN’s Sustainable Development Goals and world climate targets as well as the rise in social status has become a bonus outcome for developers and investors.

ESG and IGBC Green Building Ratings

One of the most universally accepted practices for inculcating environmentally friendly, low-impact and green measures in buildings and the built environment sector is to adopt an IGBC Green Building Rating. It provides a definitive framework for the inclusion of green measures and assessment of impact. The Green Rating acts as a tool not only for implementation but also to assess performance and measure the value received due to its adoption.

Economic Impact: From a stakeholder’s point of view, green buildings are proven to make business sense - they are energy efficient, consume less water, minimize waste, and decrease operational costs. They also tend to have higher rental values and occupancy rates than their conventional counterparts.

The risks posed by climate change to property assets are significant and result in huge expenditures. Finance institutions and insurance agencies also consider climate risks before insuring properties. It is essential that businesses be resilient and manage the risks posed, which are minimized for IGBC Green Building rated assets.

There is an ever-expanding evolution of green finance and bonds in the market which offer special considerations to companies based on their ESG standings. Financial institutes across the globe like International Finance Corporation, Asian Development Bank, etc, are facilitating climate-linked funds, which make investing in sustainable measures accessible. Several governing bodies in India have also offered incentives on adoption of IGBC green building rating.

Today, IGBC Green Ratings are also synonymous with the implementation of quality green practices in the general populace. They can act as a key marketing and communication tool to convey the ESG measure and sustainability stance of organizations.

Social Impact: IGBC Green Building Ratings also account for the social aspects of ESG Reporting by advising on practices that improve Health, Safety & Well-Being.

All IGBC green rating systems inculcate the principle of occupant well-being and include safer and healthier practices that significantly enhance the quality of life of all involved. The rating criteria adhere to best practices that create improved worker conditions, strict adherence to worker safety, site practices that ensure minimal disturbance to the neighborhood, reduce dust pollution by employing prevention measures, and proper storage and disposal of scrap and wastage. IGBC green rating systems also advocate universal design, ensuring that buildings cater equally well to differently abled and senior citizens.

The principle of people-centric design is an integral part of green buildings which emphasizes the role the built environment plays in relation to the wellness of the occupant. Research shows that major disease transmission happens indoors as built-up pathogens cause “sick building syndrome”. This is exacerbated by overcrowded layouts, and lack of green space or access to outdoors, highlighting the importance of the built environment to both public health and carbon emissions. IGBC Green Building Ratings address these problems by advocating for healthier spaces that offer thermal, visual, acoustic, and olfactory comfort.

The area of Corporate Social Responsibility (CSR) through which businesses give back to the community, is also an indicator of ESG targets of organizations. The IGBC Green School and IGBC Green Villages ratings are being increasingly adopted by corporations to serve their local communities. The ratings focus on developing the infrastructure for education and healthcare, providing water and power security, improving hygiene, aiding economic development, developing digital infrastructure, etc. The ratings facilitate a comprehensive approach to sustainability that offer multifold benefits.

Governance Impact: The IGBC Membership & Certifications offered by rating bodies can add value to the governance policies of the organizations as corporations can affect change to a much greater level. With the sheer size of resources utilized by establishments - be it material, manpower or machinery - sustainability as a tenet can have an enormous impact across their supply chains.

IGBC Green Ratings address national priorities such as water conservation, energy efficiency, reduction in fossil fuel use, conserving natural resources, handling of waste, and overall improvement of quality of life. The IGBC Green Rating frameworks and services help organizations set their long-term environmental strategy, handhold on their approach to net zero, and achieve their climate goals.

Hence, the adoption of IGBC Green Building Ratings is a proven metric of the adoption of sustainable practices, make economic sense, and result in overall improved quality of life, which can in turn contribute to the ESG Reporting of companies.