According to KPMG in India and Colliers’ Report on ‘Sustainable Real Estate’, India contributes to about 7.3 per cent global emissions with real estate being one of the largest contributors, hence, the importance of sustainability in the sector cannot be overstated. The carbon emissions may reach 4.48 giga tons by 2030 from 2.88 giga tons in 2021, however, reduction in emissions by 22 per cent today can keep 2030 emissions lower, at 3.48 giga tons.

Energy-efficient technologies such as automated HVAC systems, solar panels, and green roofs may result in 70 per cent less waste and 10 per cent savings in operational cost yearly.

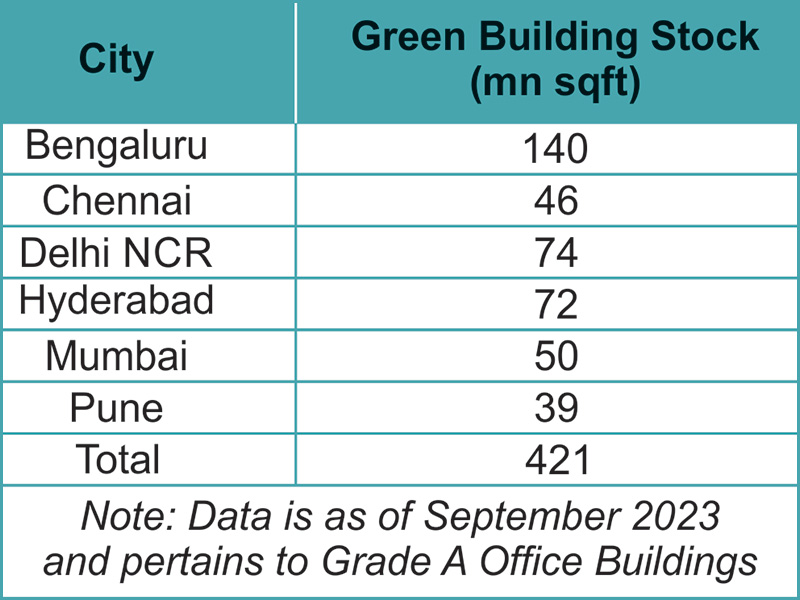

Additionally, the report highlights that in top 10 office micro markets in India, including Bengaluru ORR, Whitefield, and SBD; Hyderabad SBD; Chennai OMR Zone1, Pune- Kharadi; Delhi NCR- Noida Expressway; and Navi Mumbai, account for the bulk of country’s green building stock at 62 per cent.

These top micro markets are largely a part of suburban and peripheral areas that consist of newer developments. At the same time, the vacancy levels in green buildings of most of these micro markets is lower than that of non-certified buildings.

“Green certified office buildings have almost doubled since 2016 to an impressive 421 mn sq ft, forming over 60 per cent of India’s Grade A office stock. This showcases developers’ and occupiers’ rising commitment towards sustainability. This is likely to reflect in terms of favorable pricing and asset valuation resulting in increased brand value, client retention and rental upside. As the industry looks into the future, developers and investors alike are likely to remain focused on high performing assets as more occupiers will scout for sustainable workspaces.” said Badal Yagnik, Chief Executive Officer, Colliers India.

Going ahead, faster adoption of sustainability in real estate, green financing, innovative interventions undertaken at portfolio-level, and attracting sustainable investment through dynamic policy making becomes an imperative. Simultaneously, concerted efforts towards provisioning better funding for sustainability research and development must be augmented.

Lastly, the report delves deeper into the multifaceted facets of this transformative journey, exploring green building standards, occupier initiatives along with actionable recommendations to shape a more sustainable future.